Estimated Reading Time: 9 minutes

You’ve probably asked yourself this before:

“How much does a restaurant loyalty program cost… and is it worth it?”

Some platforms say “free”, others charge anywhere from $20 to $100 per month. Then you hear about brands like Watsons or Walgreens spending hundreds of thousands just to keep their loyalty programs alive. So where does that leave restaurant owners looking for affordable restaurant loyalty programs that won’t eat into razor-thin margins?

The cost of a digital loyalty card system isn’t just about the monthly fee. It’s rewards, setup, software costs, marketing — and, if you’re not careful, the hidden cost of lost revenue.

The true cost of running a loyalty program goes beyond just the loyalty program software cost — it’s about understanding the total budget for loyalty programs and the long-term loyalty program ROI (Return on Investment) you’ll get in return.

However, once you know how to calculate the cost of a loyalty program, you’ll see why the right one pays for itself.

Why Loyalty Program Costs Matter

In the restaurant industry, margins are razor-thin. Every drink, birthday perk, or cashback point has to justify its existence. That’s why understanding the true cost of a loyalty program is extremely important. It’s not just about “giving rewards”, it’s about structuring a system that builds long-term value.

To see why, let’s look at how both local brands in Malaysia and global giants in the U.S. approach loyalty investments.

Local Brands That Pay Customers to Stay Loyal

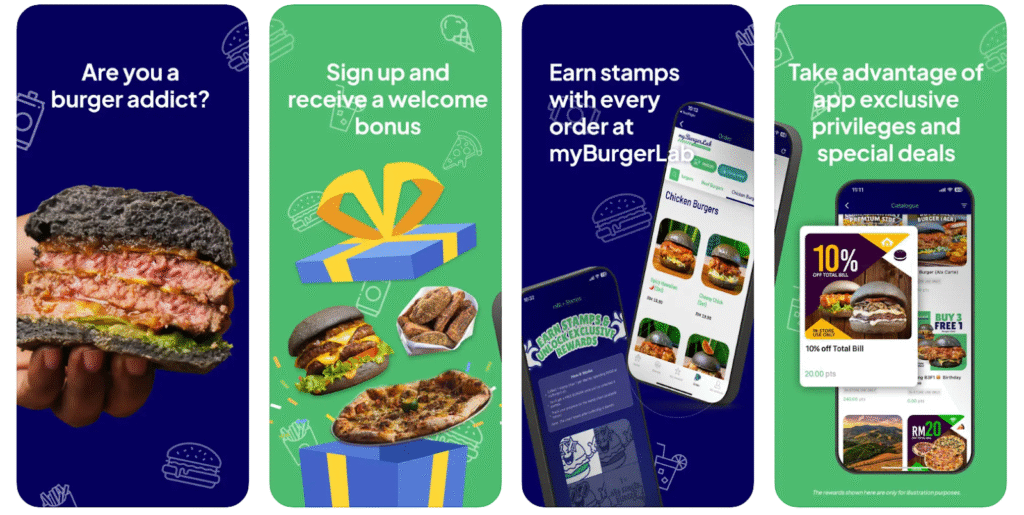

Take MyBurgerLab, a homegrown burger chain. Since 2018, they’ve invested between RM190,000 – RM210,000 ($40k – $44k) into their loyalty app. That figure includes app development, maintenance, and the ongoing rewards budget. For a single-location restaurant, that’s a massive commitment.

MyBurgerLab sees loyalty as an investment in retention.

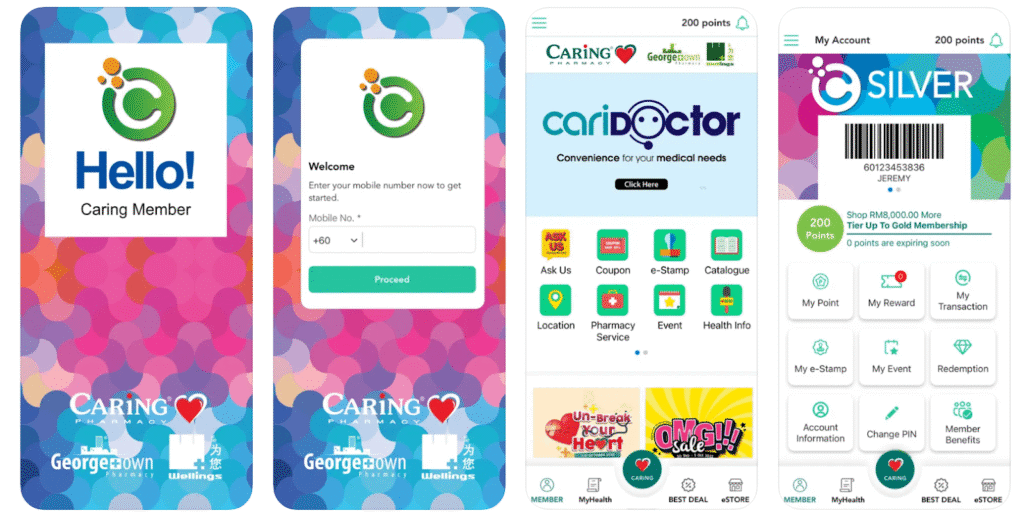

Caring Pharmacy took it even further. The company is estimated to have poured nearly RM1 million ($210k) into development and customer acquisition. Why spend that much? Because they know acquiring a new customer can cost five to twenty-five times more than retaining an existing one. By spending upfront, they’re locking in long-term loyalty.

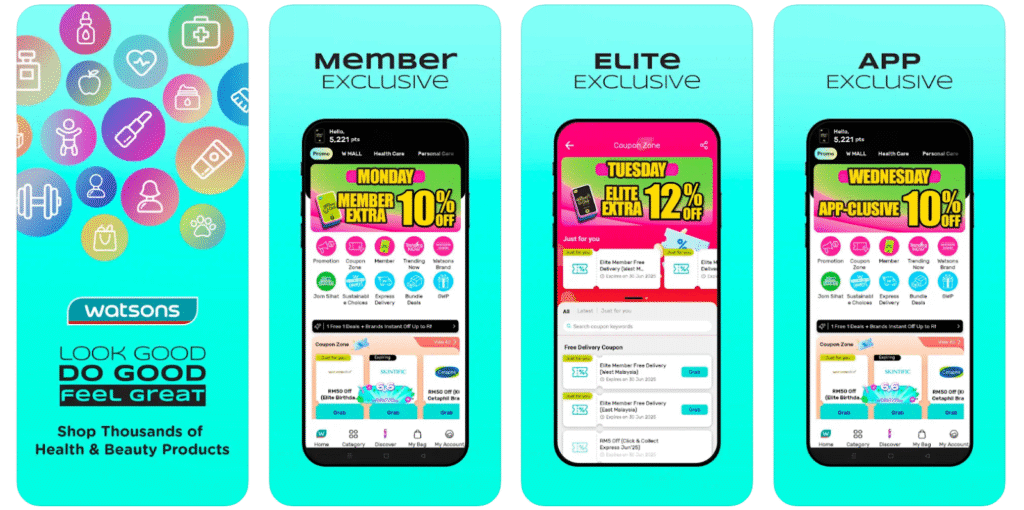

Even mid-sized players like La Juiceria and Manjaku have invested hundreds of thousands [(RM200k and RM700k+ ($42k and $147k respectively)] into their loyalty ecosystems. Their investment shows that even niche brands view loyalty tech as a must-have. And like Watsons, which regularly offers cashback and free gifts just for app sign-ups, these brands understand that customers don’t just download apps for fun. They do it because they’re getting real value in return. By investing heavily in customer acquisition, Watsons ensures competitors can’t easily lure their regulars away.

U.S. Giants Doing the Same

This isn’t unique to Malaysia. Some of the biggest U.S. brands have proven that loyalty program pricing isn’t an expense, but a long-term growth strategy.

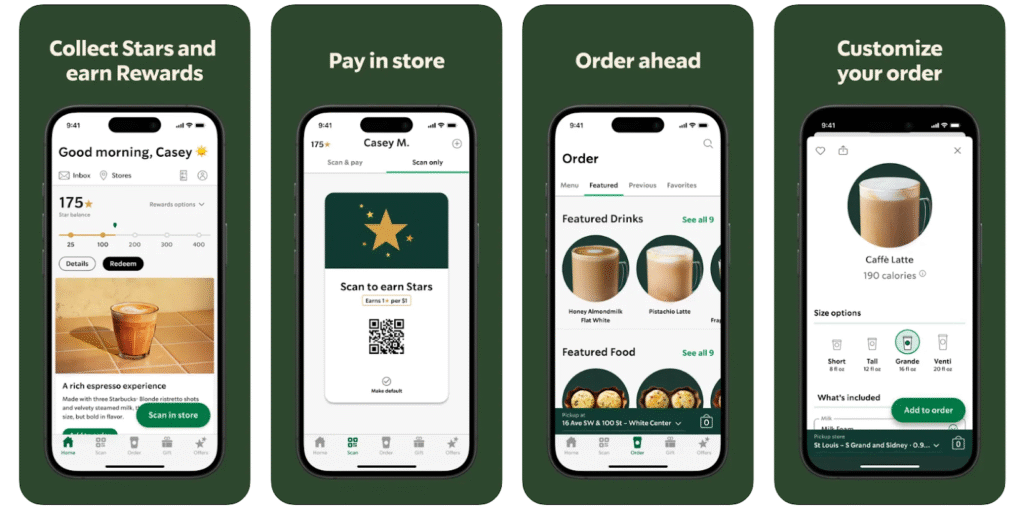

Take Starbucks Rewards as an example.

Starbucks Rewards has more than 30 million active members in the U.S. alone. Why? Because Starbucks incentivizes app downloads with free drinks, double-star days, and exclusive promotions. For Starbucks, the monthly cost of a restaurant loyalty program is outweighed by the guaranteed revenue stream from prepaid balances and increased visit frequency.

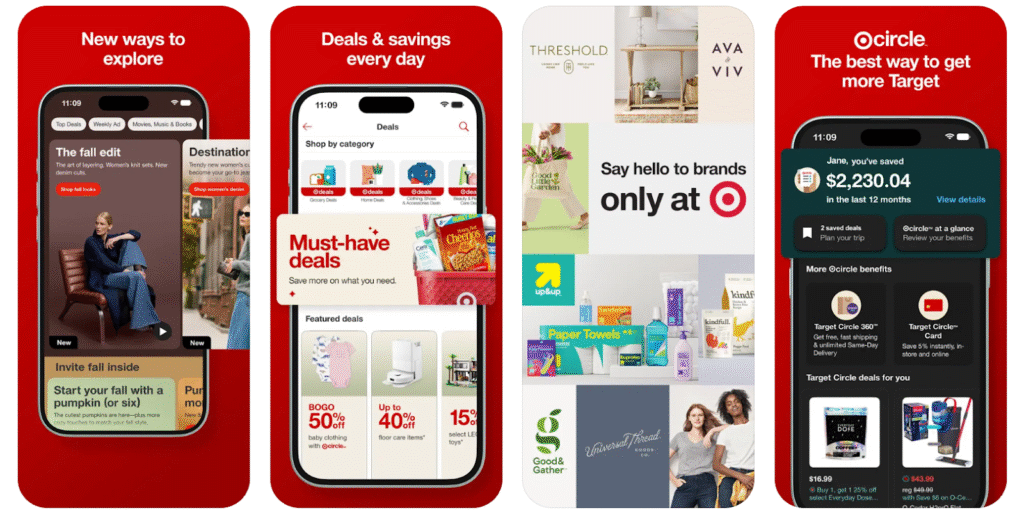

Target Circle hands out 1% cashback on every purchase, personalized coupons, and birthday discounts. All app-exclusive. Target captures detailed insights on shopping habits and uses them to optimize promotions. This way, customers know they’re losing money if they don’t use the app.

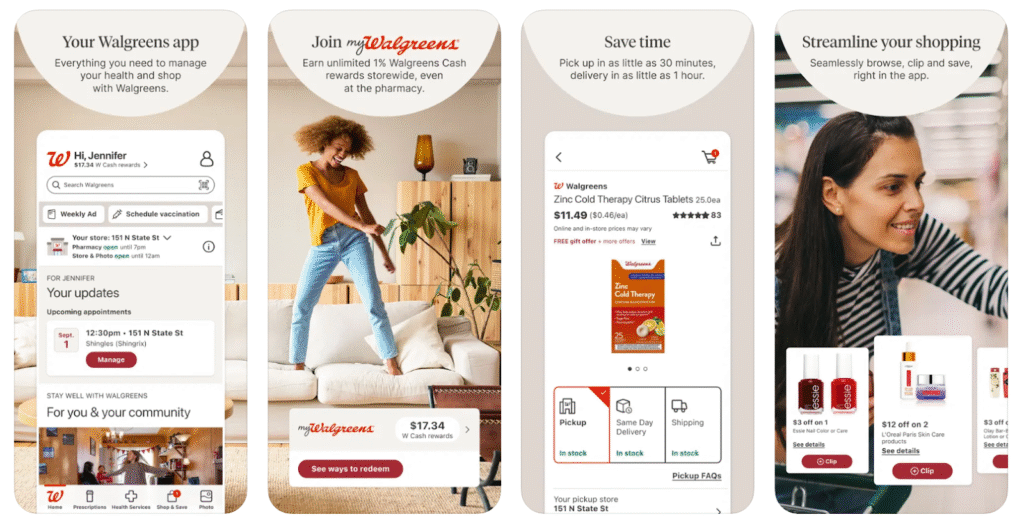

Even Walgreens ties its loyalty system to health tracking. Walgreens Cash Rewards reward customers for steps taken, prescriptions refilled, or fitness activities logged through the app. This turns the loyalty app into more than a shopping tool, but a part of a customer’s lifestyle. That stickiness drives long-term retention in a fiercely competitive pharmacy sector.

Across markets, the pattern is clear: whether it’s Watsons in Malaysia, or Target in the U.S., successful brands spend heavily to get customers into their loyalty ecosystems. All because they know the ROI (Return on Investment) pays for itself many times over.

The Cost of Free Loyalty Programs

Yes, free loyalty apps exist. They’re tempting. But just like free samples at your local supermarket, you’ll have to end up paying for them in ways you didn’t expect.

The Upside of Free

Free apps do serve a purpose, especially if you’re just dipping your toes into loyalty marketing:

- Zero upfront cost: No need to budget; you can launch tomorrow if you’d prefer to.

- Easy testing ground: See if customers engage before investing.

- Quick setup: No coding, no POS (Point-of-Sale) integrations. Just sign up and go.

A smart entry point for the curious but cautious restaurant owner who wants to “try before they buy”.

The Hidden Price Tag

Here’s the catch: free loyalty apps often come with invisible strings attached. Free isn’t really free.

- Limited features: Forget about SMS marketing, personalization, or tiered loyalty.

- Branding issues: Customers see the app’s logo, not yours. It’s basically free advertising… for them.

- Customer caps: You’ll hit a limit on users and suddenly face an upsell.

- No data insights: You won’t know who your regulars are, how often they return, or what actually drives sales.

Even Watsons (a major retailer) still needs to incentivize customers to download their app with rewards and promotions.

And customers downloading an app doesn’t mean it stays installed. Uninstall rates are incredibly high. To keep your loyalty app alive, you’ll need to continuously invest in content, promotions, and engagement strategies to ensure customers don’t delete it.

That, of course, is easier said than done.

So, while the price tag says $0, the opportunity cost of missed revenue can be far higher.

The Cost of Paid Loyalty Programs

Paid platforms come with a monthly bill, but they also open the door to features that actually move the needle.

Typical Pricing Models

- Flat monthly subscription: The most common, usually RM100 to RM500/month ($21 – $105) per store, depending on features.

- Tiered pricing: Basic plans for small outlets, premium plans with restaurant SMS marketing and automation for bigger brands.

- Per-transaction fees: Some providers charge per reward redeemed (beware of this; costs can add up fast).

Additional Costs to Consider

The monthly fee isn’t the whole story. Beyond the subscription, your restaurant should budget for:

- Setup & training: Time spent onboarding staff. Keep it simple. Programs like SimpleLoyalty only need a phone number.

- Marketing: Posters, menus, digital ads, or win-back SMS campaigns to promote your program.

- Rewards: Free dishes, discounts, or birthday perks. These are costs, but they’re also customer magnets.

- Ongoing management: Tracking data, refreshing offers, and making sure your program stays exciting.

The main difference between free and paid is this: paid programs scale. They give you tools to automate, analyze, and actually prove ROI.

Calculating the True ROI

Let’s put some math into this. How much should a loyalty program cost? The answer lies in ROI.

Let’s take a simple example:

- The average cafe customer spends RM30 ($6.30) per visit.

- Without loyalty, they come in 2x/month = RM60/month ($12.60).

- With loyalty, they bump up to 3x/month = RM90/month ($18.90).

- That’s an extra RM30 ($6.30) per customer, per month.

Multiply that by 200 customers and suddenly you’re raking up RM6,000 ($1,260) more each month.

Now subtract:

- RM200/month ($42) for the loyalty platform.

- RM1,000/month ($210) in reward costs.

You’re still netting RM4,800/month ($1,008) extra revenue just by giving customers a reason to come back.

That’s the power of a well-structured loyalty program.

The Hidden Cost of Not Having a Loyalty Program

The most expensive option? Doing absolutely nothing.

- Lost regulars: Customers drift to competitors who reward them.

- Zero data: You don’t know who your VIPs are, so you can’t market to them.

- Lower retention: Repeat customers (20-40% more profitable than first-timers) never stick around.

It’s like leaving money on the table and then watching your competition pick it up.

How Much Does It Really Cost?

Here’s the breakdown:

- Free apps: Zero upfront, but costly in lost data and brand control.

- Paid platforms: RM100 – RM500/month ($21 – $105) plus reward costs, but scalable, trackable, and profitable.

- No program: Thousands in lost revenue every year.

The real cost isn’t what you pay monthly. It’s what you stand to gain or lose in customer loyalty and repeat revenue.

Conclusion

Margins are tight. Customers are picky. And every “free” reward has to prove its worth.

The good news is that a loyalty program isn’t just another expense. It’s one of the most effective customer retention tools you can invest in. Free apps are fine for testing the waters, but if you’re serious about growing your restaurant, a paid program pays for itself (and then some).

The brands that win — whether it’s MyBurgerLab in Malaysia or Starbucks in the U.S. — are the ones that understand loyalty isn’t a cost. It’s an investment that pays for itself many times over.

Build your loyalty card today with SimpleLoyalty, it only takes 10 minutes!